Head of Strategy @ Yassir

July 2020 - Present-

Yassir is the leading super-app in French speaking Africa and offers a multitude of services including ride-sharing, food delivery, grocery delivery, 15 minute delivery, ghost kitchens, peer-to-peer payments, remittances, & mobile banking. Founded in 2017, Yassir entered Y Combinator’s Winter 2020 batch and closed a $30M Series A in 2022. Yassir is currently the largest on-demand consumer application in North Africa and operates in the following countries: Algeria, Benin, Canada, France, Ivory Coast, Morocco, Senegal, South Africa, Togo, & Tunisia.

-

As Head of Strategy, I was responsible for global strategy and international expansion efforts across all markets. This included but was not limited to the following:

› Building financial models & strategy playbooks for international expansion

› Working on payment licenses with legal partners across all geographies

› Modifying the organizational structure for 600+ employees

› Managing creative strategy & developing global advertising campaigns

› Developing the strategy for new market & new product launches

› Syncing with cross-functional teams to manage pricing & supply issues

› Assisting in the product management & development of payment application

Creative Revamp

Having grown exponentially in just under one year, more than tripling our workforce and launching into multiple new countries, we quickly realized that we were sacrificing brand identity and visual coherence for the sake of speed. Rapidly launching and beating competition became a priority, often at the expense of creative uniformity and refined content. This led to confusion amongst consumers and hindered cross-selling initiatives between different business services. Yassir’s visual identity would alter drastically depending on the country or service. As a result, acquiring customers often required additional resources and a renewed focus on brand education which proved costly in the long run.

In November 2021, I hired and began managing an experienced group of global advertising professionals in order to rework our brand identity and launch polished creative campaigns across our markets. These professionals were located across the USA, Canada, France, & Lebanon and ranged from Creative Directors, Art Directors, Animators, Designers, Cinematographers, Video Editors, & more. Our goal was simple, modernize Yassir’s brand image and content without sacrificing the company’s DNA. The work was done in two portions: Brand Identity & Creative Content.

Brand Identity

Our first exercise as a group was reworking Yassir’s brand identity. This entailed conducting in-depth research in regards to our markets and target audiences in order to determine Yassir’s ideal positioning. We quickly discovered that our highest performing users were between the ages of 18-35, skewed female, and were often times young professionals with ample disposable income and an appetite for on-demand consumer services. As a result, our first order of business was rejuvenating our color palettes, logos, and design templates. Tweaking our brand guidelines would prove to be paramount in developing a solid foundation for future creative initiatives. Doing the necessary preliminary work and identifying a clear ‘North Star’ allowed the team to dedicate itself fully to the project. The goal was to make the Yassir brand fun, friendly, & accessible.

Creative Content

The new creative team served as Yassir’s research & development branch, pushing boundaries in order to develop visually appealing creative content that could grasp users’ attention. Rather than relying on preexisting templates or auditing what the competition was doing, the idea was to test the limits of Yassir’s creative capacities and build a cohesive visual identity that could be leveraged across geographies.

Prior to our work, Yassir was accustomed to utilizing the same types of content across all acquisition channels. This quickly led to complacency and creative fatigue. The following is a snapshot of creative content prior to our R&D work:

The initial task was to leverage existing talent on the team and squeeze out as much added value as possible. We soon realized that many of the content creators on the original design team were extremely talented but simply lacked the guidance and authority to push boundaries and pursue interesting concepts. After some slight nudging, we were able to produce the following content in a matter of weeks:

Once this preliminary creative exercise was complete, Yassir’s newly assembled advertising hub began working on an overarching creative campaign that would accompany all new country launches across the African continent. After months of market research, dozens of scrapped concepts, countless syncs with local data and strategy teams, and innumerable roadblocks along the way, the team put together a creative campaign that piqued the interest of users across Africa. The following is a brief overview of some of the work that was done:

Dark Store Launch

The second half of 2021 spurred a seismic shift in the consumption habits of on-demand users globally. Having grown accustomed to traditional methods of delivery, industry pioneers such as Getir and GoPuff invested heavily in differentiated last-mile logistics offerings, providing quick commerce solutions at the same cost to consumers as traditional e-commerce players. 15-minute delivery soon took off and precipitated a deluge of market entrants hoping to gain a piece of the pie. Soon, competitors like Flink, Cajoo, Gorillas, and countless others started crowding the market.

Given the fact that Yassir already ran successful food and grocery delivery operations in most of its markets, we decided that it would be a worthwhile pivot to begin offering quick commerce services to our users. We planned on offering a wide array of products to users in major metropolitan areas with 30 minutes. Since most of our operations were located in Africa, we encountered less stiff competition to start which allowed us to hit the ground running. The work was done in multiple phases and involved financial projections, market research, user segmentation, user positioning, user targeting, inventory analysis, FMCG procurement, dark store conversion, & more.

Financial Modeling

The first order of business was developing a robust financial model that would incorporate all the different facets of operating a dark store. Contrary to traditional delivery methods, quick commerce presents a series of operational challenges that need to be addressed upfront. Given the structure of the business, small alterations to the business model can drastically impact the bottomline. After many iterations, I finalized an all-encompassing revenue model that allowed us to accurately project revenues & expenditures over a 5 year period. The inputs proved to be incredibly granular, covering data points such as active neighborhoods, # stores per neighborhood, average floorspace, shelving layout, average basket size, commission per order, CAC, gig vs. full-time workers, scooter and apparel cost, inventory amount, excess inventory %, orders per batch, max delivery time, P3 utilization, packing rate, employees per dark store, subscription pricing, & more.

Operations

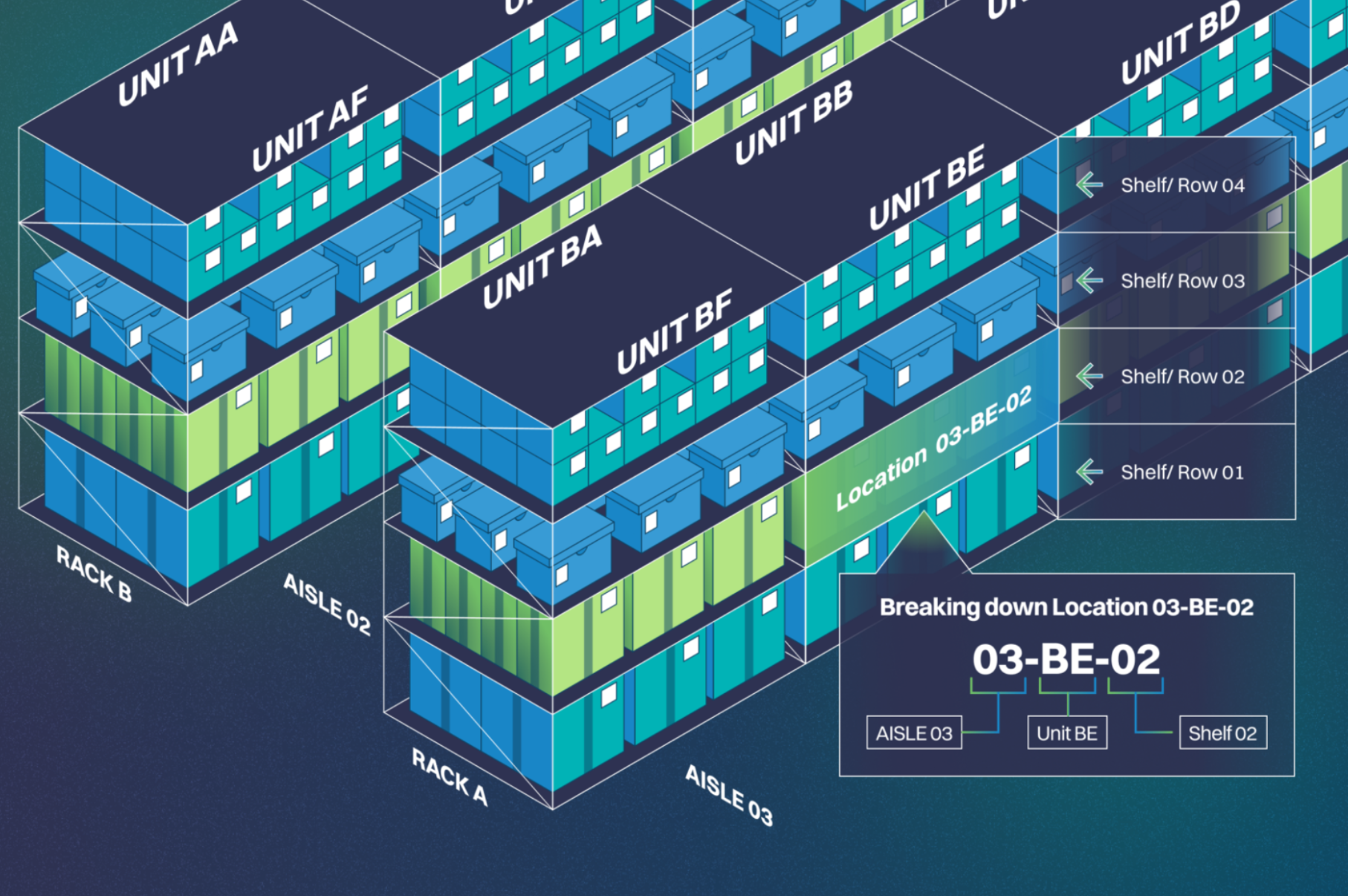

Once the preliminary work had been done, we then need to develop operational processes that could be followed in all of our different markets. Dark stores require robust processes and clear guidelines in order to operate efficiently. Prior to launch, I helped develop a comprehensive set of instructions that would help guide operational teams. This included optimizing dark store locations around high-demand areas, managing inventory and product categories, integrating a barcode scanning and POS system, refining dark store zoning and delivery radius, hiring required local profiles, developing relationships with local and international suppliers, clearly structuring and labeling product shelving, optimizing the pick/pack process, tweaking dark store layout based on data insights, managing delivery couriers and vehicle fleet, & more. Attached is an example of a potential dark store shelving layout:

Marketing

In order to market our dark stores, we leveraged a blend of online and offline initiatives in order to create a buzz. Clear segmentation, positioning, targeting, demographic, and geographic work needed to be done in order to determine which user profiles were most likely to benefit from our quick commerce services. Depending on the market, our ideal user profiles ranged from young professionals to busy parents and included everything from household products, to snacks and cooking oils.

We first created digital content that could quickly be amended depending on customer feedback. This content oftentimes highlighted high-demand products that we held in inventory and doubled down on our 15+ minute delivery offering. Cross-selling also proved to be effective and allowed us to target VTC or food delivery users that had placed orders within our initial dark store radiuses. Consequently, given the fact that we knew exactly which households occupied our dark store delivery radius, we established aggressive street marketing campaigns that touched most houses within each radius. This allowed us to quickly create a buzz and exponentially increase demand. In a matter of weeks, with properly formulated acquisition and retention offers, we were able to become the largest player by order volume in many of our markets.

Payment Licensing

Yassir’s ambition is to offer a robust suite of financial services to users and businesses across Africa. This includes but is not limited to peer-to-peer payments, remittances, mobile banking, business lines of credit, payment gateways, digital wallets, & more. FinTech adoption has been staggering across many African nations, with up to 40% of adult populations in some countries using digital wallets to store money and initiate transactions with local SMBs. In Senegal, for example, most utility bills are payed directly via mobile application through either Orange Money or Wave.

In February 2021, the CEO approached me to begin working on payment licensing initiatives across all our operational markets. In order to fulfill our obligation to users and become a full-fledged super-app, we needed to ensure regulatory compliance for all our payment related services. The initial stages involved extensive research on payment licensing procedures and best practices. Since Yassir operates in Africa, Europe, & North America, I first had to understand the different regulatory frameworks in each region and subsequently partner with local law firms in order to work on application packages. This consisted of analyzing local regulations, formulating business plans, constructing financial models, notarizing required legal paperwork, incorporating local business entities, opening and capitalizing bank accounts, hiring local talent, appointing a board of directors, mapping our technical stack, integrating with third-party service providers, opening and operating SWIFT centrals, working directly with Central Banks, & managing development of Yassir’s payment application, amongst other things.

Preliminary Research

The research phase first involved determining the regulatory hurdles for payment licensing in each region we operate in. Since we were looking to get approval in as little time as possible, we had to quickly narrow down our options and pinpoint the countries that offered the quickest approval timelines.

In Europe, Lithuania and Cyprus proved to be the best options, providing a comprehensive licensing package and access to SEPA while guaranteeing approval in 8-12 months rather than the customary 18+ months in other European nations. We partnered with local law firms in both Lithuania and Cyprus to expedite the application process and mitigate any risk. Ultimately, Russia’s invasion of Ukraine derailed our application plans in Lithuania, and we were forced to focus exclusively on Cyprus.

In Africa, payment licensing proved to be incredibly bureaucratic, relying on prolonged conversations with government officials and archaic processes that were difficult to navigate. Electronic Money Licenses, as issued by the BCEAO, were exclusively held by large telecom players such as Orange, with Wave only recently being able to finally obtain approval for an individual license. We ultimately decided to partner with a large African bank in the interim in order to launch our payment app, allowing money to be issued and users to transact, while simultaneously lobbying the BCEAO for payment licensing approval.

In North America, we focused on obtaining a Canadian license, given our existing operations in Montreal and large African population present throughout Canada. The Canadian MSB licensing process was fairly straightforward and resembled the work we were doing in other markets.

Application Phase

Once we determined the best path forward for licensing, I was then tasked with developing business plans and financial models for all markets. This included a detailed overview of licensed business activities, consumer and corporate products, SWOT and STP analyses, demographic research, user persona development, market analysis, economic outlook, IT infrastructure, preliminary contracts, & financial projections.

It was crucial to provide a granular view of the services we planned to offer to users. This involved developing an in-depth understanding of the e-money landscape, potential limitations, competitive advantages, and pricing dynamics at play. Our suggested services spanned account opening and holding of customer funds, cash placements ‘to’ and withdrawals ‘from’ the e-wallet account, execution of payment transactions, issuance of payment instruments, foreign exchange, payment gateways, money remittance, card services, & business lines of credit.

After months of revisions, an acceptable application package was ready to present to central authorities for approval. The next steps required the incorporation of a local entity, the opening of a bank account, and the appointment of a board and local team. In order for applications to be processed, Yassir needed a General Manager, Regulatory Officer, & AML Compliance Manager in addition to a board which consisted of local financial experts and existing high-ranking Yassir employees.

The final stages of the application process were mostly technical and involved integration with existing payment centrals. In Lithuania & Cyprus, the local central banks maintained a proprietary protocol to initiate SEPA payments. Yassir needed to make sure that its application was compliant in order to properly integrate. In Africa, for example, our banking partner Ecobank required in-depth information about our technical stack and product wireframes in order to facilitate integration.